- #Extra payment mortgage calculator with amortization how to

- #Extra payment mortgage calculator with amortization download

- #Extra payment mortgage calculator with amortization free

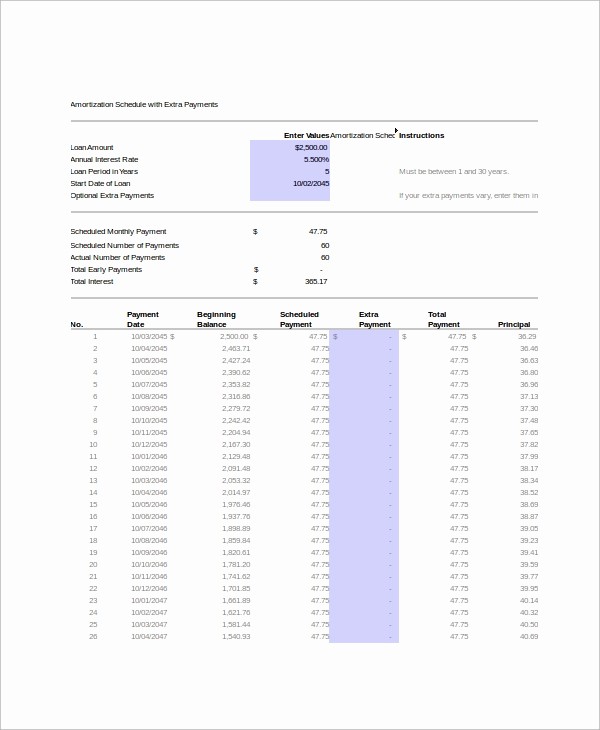

We can visualize the impact with a nice chart (requires some extra work) like this:ĭo check the download workbook for details on how the chart is setup. Go ahead and play with the table by typing some values in the “Extra payment” column. You can make biweekly payments instead of monthly payments, and you can make additional principal payments to see how that also accelerates your payoff. It will figure your interest savings and payoff period for a variety of payment scenarios. Step 3: Your mortgage will end when the “Eff. This Bi-Weekly Mortgage Calculator makes the math easy.

#Extra payment mortgage calculator with amortization how to

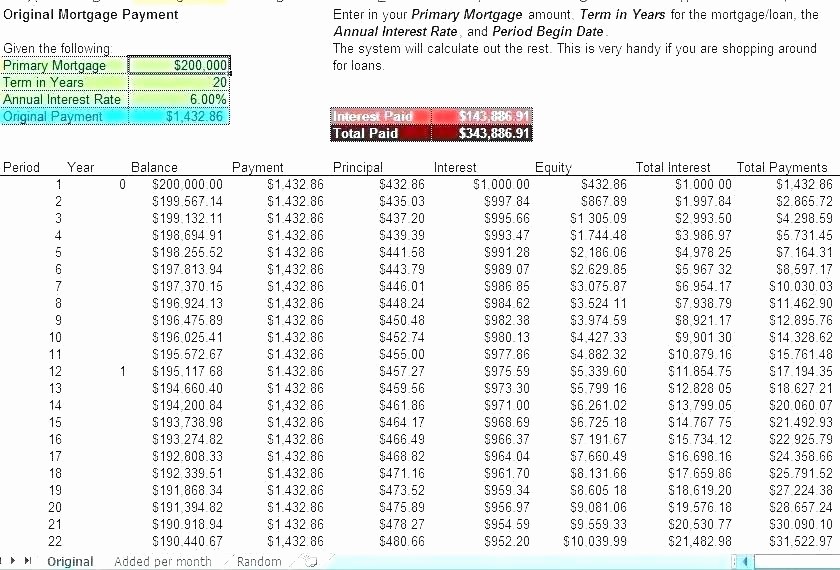

How to Calculate Monthly Mortgage Payments The monthly payment formula on how to calculate mortgage payments is given below. Closing Balance is opening balance minus principal paid minus extra payment.Ĭomplete this table with necessary formulas and fill everything down. With our amortization schedule, you can easily view each payment to learn exactly how much of your monthly payment is for interest.Extra Payment is the input column where we can type any extra payments.We can get this with the PPMT() function. You can use it to test different payment scenarios depending on your amortization period, payment frequency or the mortgage amount. Principal Paid is the amount of principal paid in each month.=ROUND(NPER($E$7/12,$E$10,$D13),0) will tell us how many months it is rounded. This means youll potentially pay less in interest over the life of your loan and may. We can use NPER function to get the answer here. By paying extra on your loan, you pay down the principal amount faster. Effective term is how long it would take you to pay off the mortgage based on the opening balance, and agreed upon monthly payment (calculated in Step 1) and interest rate (Cell E7).We also offer three other options you can consider for other additional payment scenarios. For subsequent months, this will same as previous month’s closing balance. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. Opening Balance is same as loan amount for month=1.Related: Read about SEQUENCE and other Dynamic Array functions in Excel. You can use =SEQUENCE(360) to automatically generate all the months. So, set up a range of 360 months (or longer if you want to cater for longer mortgages). In my case, let’s say loan is $500,000, term is 20 years and APR (Interest rate) is 5.35% per annum.Īs extra payment will bring down the outstanding loan term, we need to set up an amortization table to see the impact clearly. This would lead to gradually lower monthly payments.Step 1: Calculate the monthly (or weekly / fortnightly) payment:Īssuming you have the Loan amount, term & APR in three cells E5, E6 & E7, we can use the PMT() function to calculate the periodic payment. Rates are extremely high and a person believes that the rates are gradually going toĭecrease over time. If a person is going to own a home for more than 10 years, an ARM can be risky! Because they are risky, adjustable rate mortgage loans often have lower initial interest rates (which is why people seem to like them).Īnother reason an adjustable rate mortgage might be desirable is if the interest If a person knows they are going to sell a home after 7 years, then a 5/1 or 7/1 ARM might be desirable.

If a home is purchased during a period in which interest rates are extremely low, you might expect the rates to gradually increase. The calculator will calculate the time and interest savings that will occur if you switch from making monthly mortgage payments to paying 1/2 of your mortgage payment - plus.

#Extra payment mortgage calculator with amortization free

This means that your monthly payment can change! This free online calculator was created in response to numerous requests asking for the ability to add an extra or overpayment to each of the biweekly mortgage payments. After that, the interest rate can adjust at a frequency of once per year. A 5/1 ARM means the interest rate remains fixed for 5 years (60 months). There are many types of ARMs, but this spreadsheet provides a way to calculate estimated payments for a Fully Amortizing ARM (the most common type of ARM). What is an Adjustable Rate Mortgage (ARM)?

You can also edit the interest rate to be used for calculating the interest each month. The actual payment should only be the principal+interest portion (the spreadsheet does not track fees or escrow). Extra payments on a mortgage can be applied to the principal to reduce the amount of interest and shorten the amortization.

When you enter the Actual Payment, the extra payment column is calculated for you. The date the payment is received or paid is just for reference (interest is not prorated based on the date paid). In this new version (added ), columns have been added for basic payment tracking.

0 kommentar(er)

0 kommentar(er)